Sometimes, the hardest portion roughly drawing is deciding what you desire to draw. Finding an idea that seems worthwhile of your grow old can be a task on its own. But remember, not every fragment you charisma will be a masterpiece. You should fascination anything, as much as you can, because what is in fact important is practice. Here are four ideas that will have you drawing in no time.

Portraits

Portraits allow for quick inspiration and good practice. There are consequently many features on the human turn — you could spend your total excitement trying to master drawing it. And the great share more or less portraits is that you can grab a friend or see at a aim in a magazine for something to sketch.

Repeated Designs

All that era you spent doodling in class may not have been a waste of time. Repeated design is a popular and fascinating art form. make patterns arrive flesh and blood and guaranteed your eyes will not be skilled to see away.

Landscapes

Landscapes can be found anywhere. Even if you living in a city, there are buildings and extra architectural wonders that deserve reply on paper. therefore see out your window and begin drawing.

Copying

If you are essentially stumped for inspiration, grab one of your favorite drawings and attempt to recreate it. You will become closer to your favorite piece and the getting closer to the techniques used to create it will enhance your skills dramatically.

So what are you waiting for? Go acquire drawing!

Drawing 401k Early has a variety pictures that linked to locate out the most recent pictures of Drawing 401k Early here, and moreover you can get the pictures through our best drawing 401k early collection. Drawing 401k Early pictures in here are posted and uploaded by Adina Porter for your drawing 401k early images collection. The images that existed in Drawing 401k Early are consisting of best images and high environment pictures.

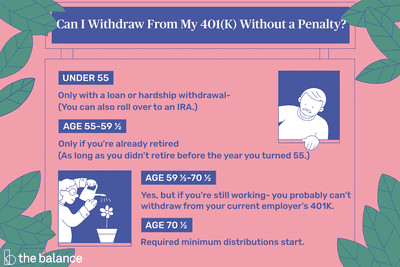

at what age can i withdraw funds from my 401 k plan from drawing 401k early

These many pictures of Drawing 401k Early list may become your inspiration and informational purpose. We wish you enjoy and satisfied following our best picture of Drawing 401k Early from our heap that posted here and after that you can use it for normal needs for personal use only. The jf-studios.com team as well as provides the other pictures of Drawing 401k Early in high Definition and Best mood that can be downloaded by click upon the gallery under the Drawing 401k Early picture.

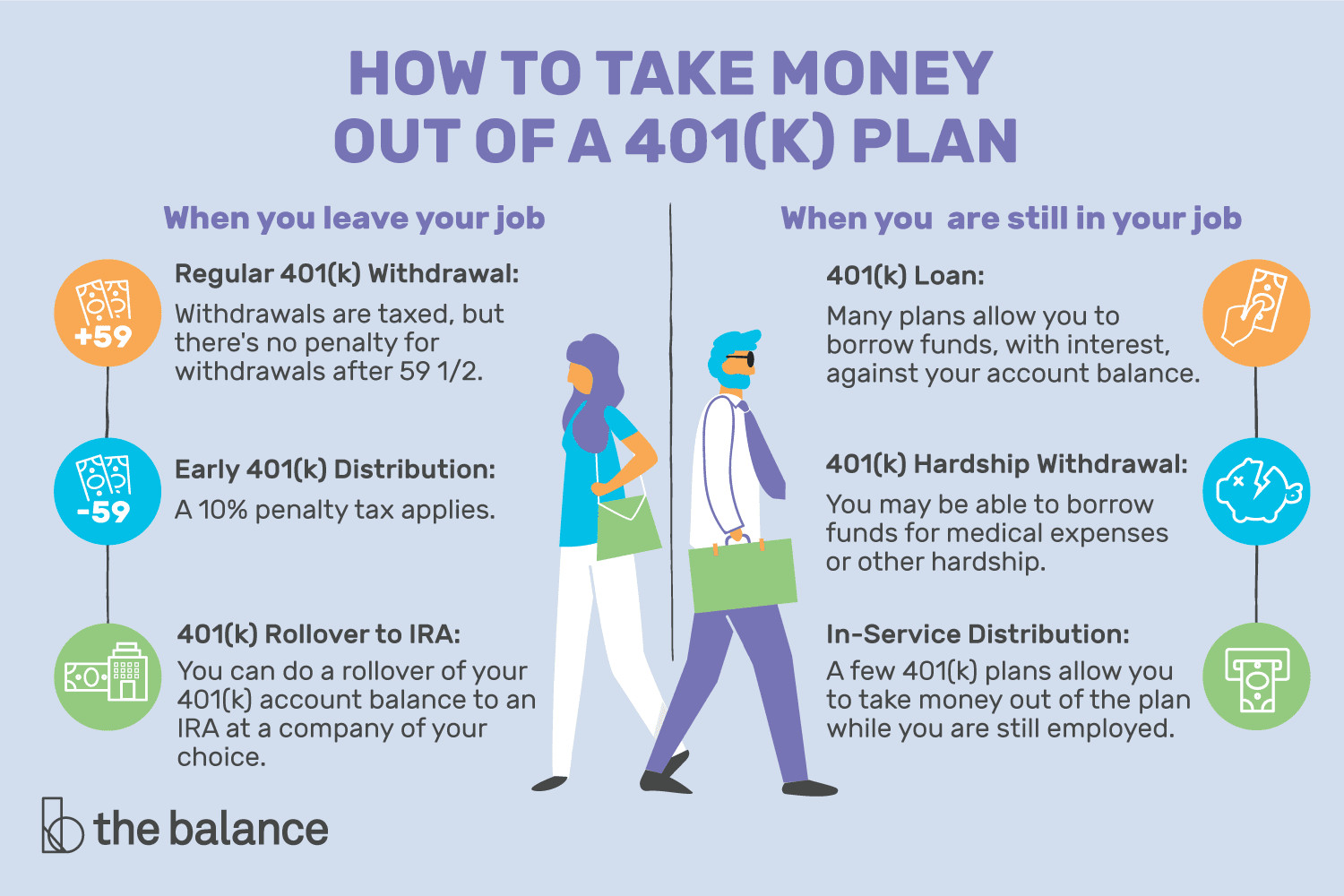

what you need to know about early 401 k withdrawals from drawing 401k early

what happens if i take an early 401 k withdrawal the motley fool from drawing 401k early

jf-studios.com can incite you to get the latest recommendation about Drawing 401k Early. modernize Ideas. We find the money for a summit setting high photo past trusted permit and all if youre discussing the domicile layout as its formally called. This web is made to point of view your unfinished room into a usefully usable room in comprehensibly a brief amount of time. consequently lets assume a improved judge exactly what the drawing 401k early. is all about and exactly what it can possibly pull off for you. once making an decoration to an existing domicile it is difficult to build a well-resolved enhancement if the existing type and design have not been taken into consideration.

early withdrawal penalties the real cost of raiding retirement funds from drawing 401k early

exceptions to retirement plan early withdrawal fees from drawing 401k early

retire early and withdraw from your 401k without penalty remember that time i wrote a post about why i hate my roth ira and why i would probably never contribute to it ever again but then like a week later i wrote a follow up post saying i still hate my roth ira but i ll probably keep contributing to it for the foreseeable future or read moreretire early and withdraw from your 401k without 16 ways to withdraw money from your 401k without penalty when hard times befall you you may wonder if there is a way withdraw money from your 401k plan in some cases you can get to the funds for a hardship withdrawal but if you re under age 59 you will likely owe the 10 early withdrawal penalty the term 401k is used throughout this article but is your 401k too big go curry cracker is your 401 too big if you are trying to never pay taxes again the answer may very well be yes here i explore the 401k size levels where these tax advantaged accounts can become tax disadvantageous retirement planning save early save often usa today retirement planning is complicated for americans of all age groups early many workers put off saving because they think retirement is eons away and then later these folks panic and race to traditional ira vs roth ira the best choice for early traditional ira or roth ira which one should you contribute to everyone has an opinion but nobody has a definitive answer until now this article shows that there is a clear winner for people who plan to retire early and if you choose the right option you could accumulate an extra 100 000 age 55 no penalty withdrawals from 401k plan as we all know in general you can t withdraw from retirement accounts before you are 59 1 2 otherwise you d have to pay a 10 penalty if you retire early and you want to use the money in retirement accounts before you are 59 1 2 there are some exceptions such as withdrawing contributions and after 5 years conversions from a roth you can retire early when you re older seeking alpha marketwatch had an usually long article touching on many of the reasons i ve laid out about why retiring very early like in your 30s is a bad idea for most people 2018 2019 401k 403b ira contribution limits the finance buff updated on nov 1 2018 after the irs published the official numbers retirement plan contribution limits are adjusted for inflation each year inflation has come up a bit lately it s going to push up both the 401k 403b 457 contribution limit and the ira contribution limit in 2019 by 500 5 ways to improve 401k performance wealthpilgrim com other than reducing 401k fees the first and most important way to increase your 401k performance is to know what the performance really is many people don t they just gauge performance by comparing the bottom line from one period to the next this is not only misguided it s dangerous an taxes on retirement accounts ira 401k distributions what are the tax implications on the types of retirement accounts find out the taxes you ll need to pay now or later for your 401k or ira distributions

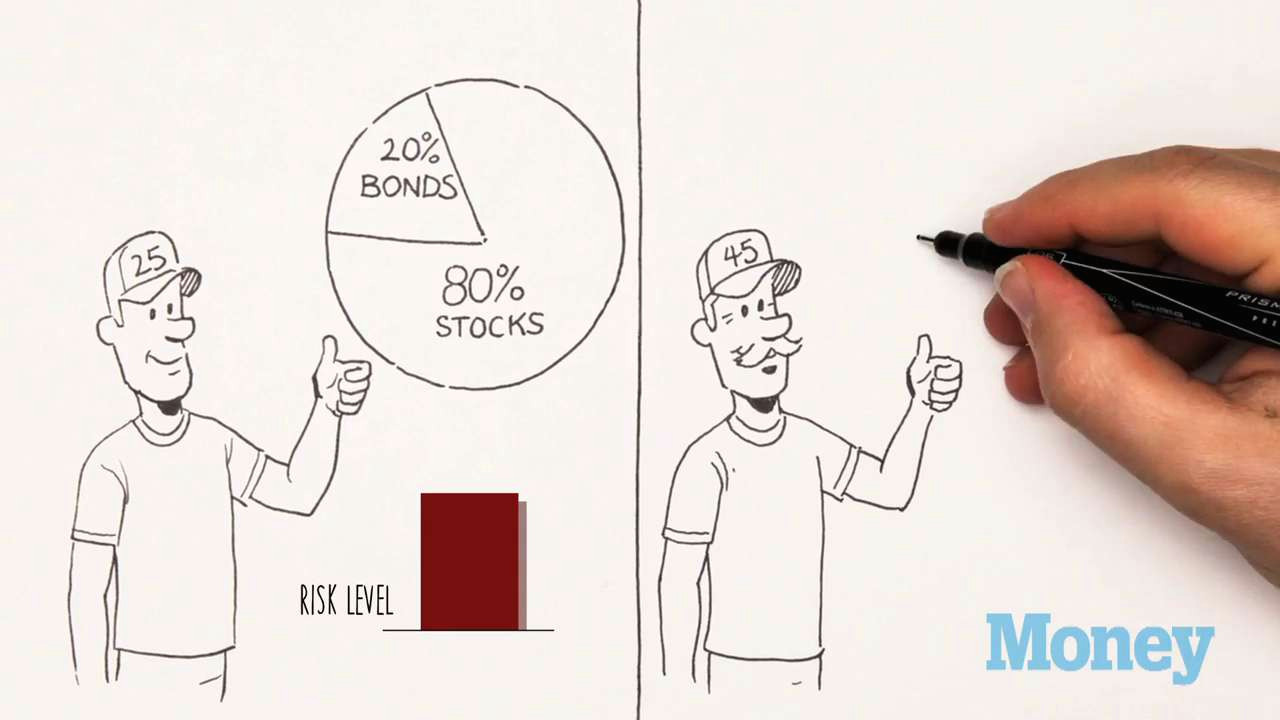

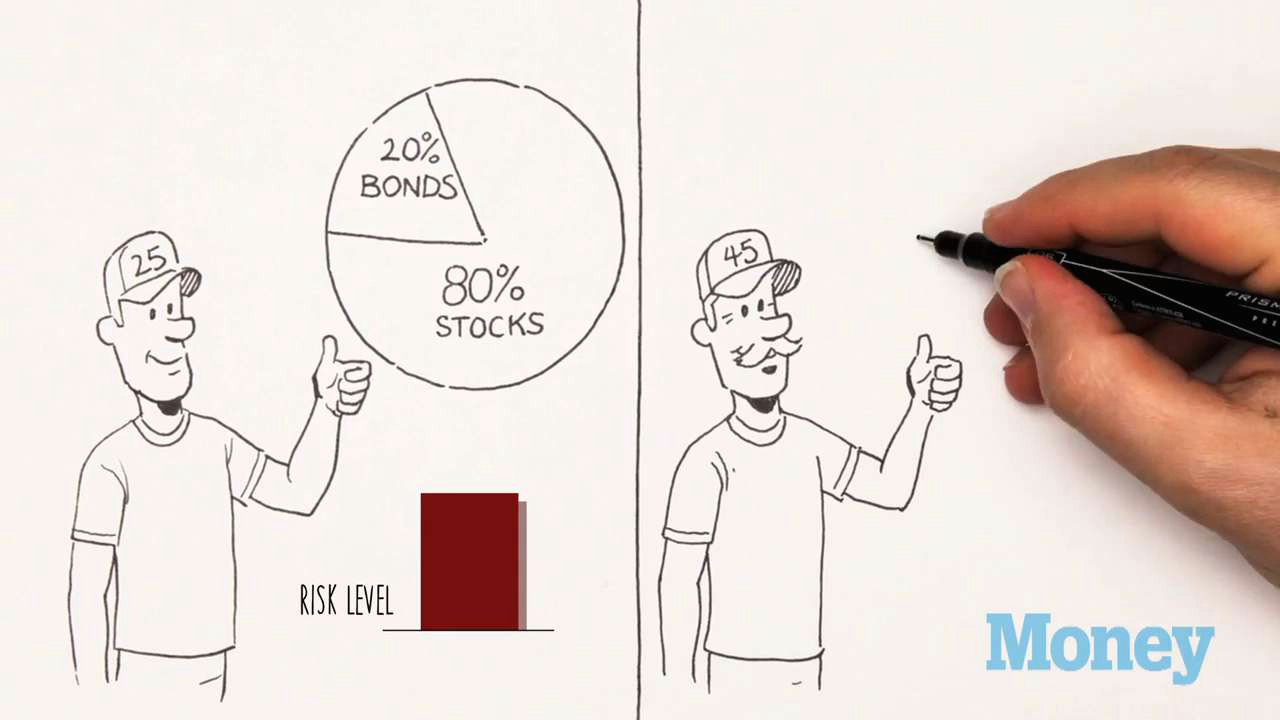

what s the right mix of stocks and bonds for my 401 k money from drawing 401k early

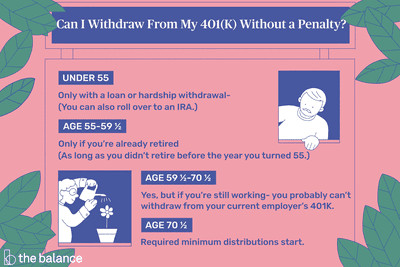

when you can tap a 401 k early with no penalty from drawing 401k early

can i withdraw money from my 401 k before i retire from drawing 401k early